read more of $90,00,000 in a plant and machinery. Tax Shield Calculation on Depreciation ExampleĪ company is reviewing an investment proposal in a project involving a capital outlay Capital Outlay Capital outlay, or the capital expenditure, refers to the sum of money spent by the company to purchase the capital assets such as plant, machinery, property, equipment or for extending the life of its existing assets to increase production capacity.

read more is a tax reduction technique under which depreciation expenses are subtracted from taxable income. It is calculated by multiplying the tax rate with the depreciation expense. A depreciation tax shield Depreciation Tax Shield The Depreciation Tax Shield is the amount of tax saved as a result of deducting depreciation expense from taxable income. A tax shield on depreciation is the proper management of assets for saving the tax.There are various items/expenses whether it is cash or noncash on which an Individual or Corporation claims the tax shield benefits Tax shield on Depreciation Tax shields lower tax bills, one of the major reasons why taxpayers, whether individuals or corporations, spend a considerable amount of time determining which deduction and credits they qualify for each year. Source: Tax Shield () Why is it Important?

#Valuation with pre and post tax cashflows how to

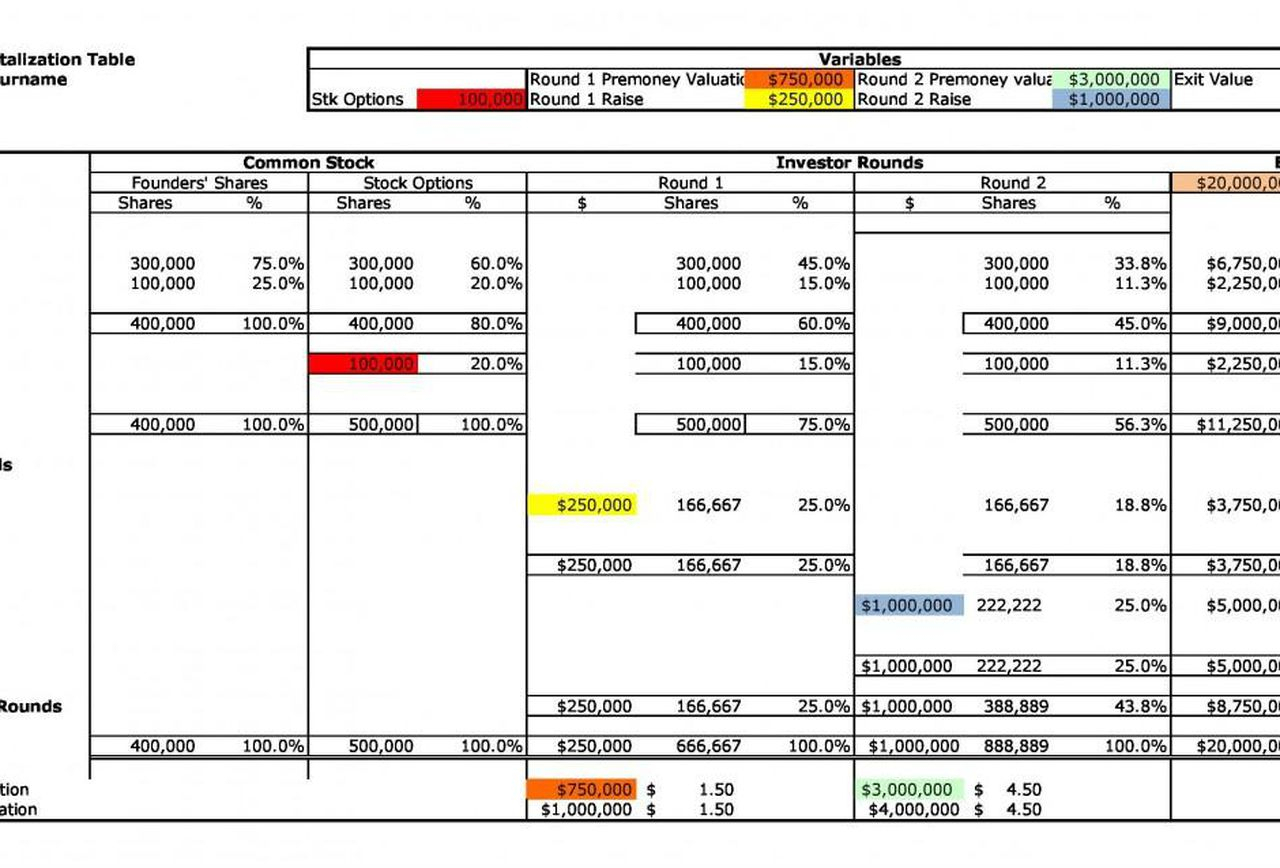

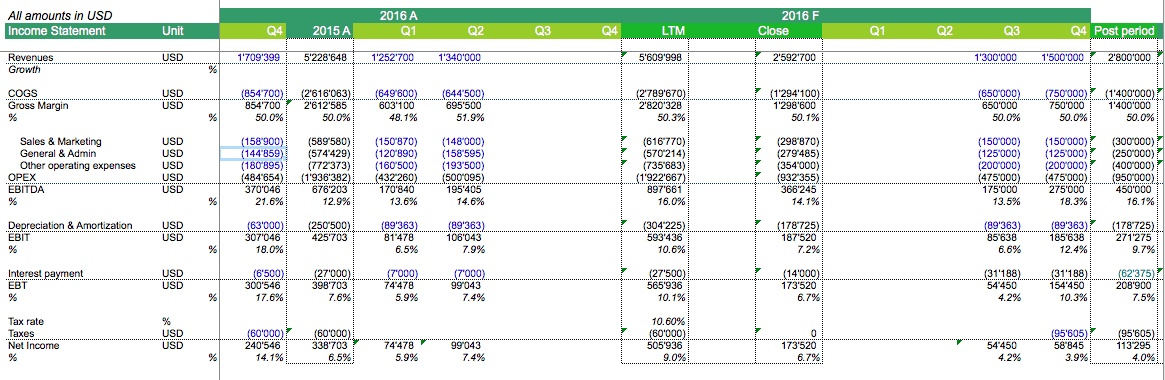

You are free to use this image on your website, templates, etc, Please provide us with an attribution link How to Provide Attribution? Article Link to be Hyperlinked Tax shield in the way of various forms involved in types of expenditure that is deductible from taxable income. They are a path to save cash outflows and appreciate the value of a firm.This strategy can increase the value of a business since it reduces the tax liability that would otherwise reduce the value of the entity’s assets.It is a way to save cash flows and increase the value of a firm. This income reduces the taxpayer’s taxable income for a given year or defers income taxes into future periods.read more, medical expenditure, charitable donation, amortization, and depreciation. Interest Tax Shield Calculation ExampleĪ tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deduction as mortgage interest Deduction As Mortgage Interest Mortgage interest deduction refers to the decrease in taxable income allowed to the homeowners for their interest on a home loan (taken for purchase or construction of the house) or any borrowings for house repair or improvement.Interest Shield in case of company or corporations.Calculation of NPV of the project ($ in ‘00,000).

Depreciation Allowances- Tax Rebate ($ in ‘00,000).

0 kommentar(er)

0 kommentar(er)